Swaps

Runaway compound interest is stretching the definition of a Giffen good a bit, but it's certainly true that i have to devote more and more of my paycheck to it as the balance keeps rising. At some point, it will overtake 100% of my potential future earnings, and theoretically zoom off to infinity. Who gets the blame is somewhat immaterial, the point is that someone with authority has to physically put a stop to it.

So, how do we solve it? First, the compound interest has to permenently stop compounding. Congress and the next few Presidents can't keep changing their minds every time it rises to the top of the agenda. Set some criteria, set up a payoff plan, and make a legitimate end point. Stop speculating on my unpayable debt, and properly budget what i CAN pay.

Second, realize that Universities are not an acceptable substitute for skills training, they are communities and repositories of knowledge and philosophy. Apprenticeships and professional training are important, but they need to be supported by industry and trade organizations, not the mandatory entry fee to being alive. Passing on practical, useful skills and ideas to future generations should be the ultimate goal for everyone, not just the economically privileged, and not just in our "school system." Likewise, bad ideas and corruption need to be held accountable for the havoc they cause. Regardless, all i care about is paying back the loans without starving or being more punished in the process.

You can look at things from various viewpoints, but the American corporate sector is simply too big for everyday consumers to support. It takes too much money, too many resources, and too much environmental damage to sustain at a reasonable level of consistency. Most major corporations and large businesses are just as insolvent as i am, but they're also "too big to fail." One factory closing is enough to bankrupt the surrounding towns and destroy thousands of lives with no real safety net to ease the burden. There is no reset button, just pointless starvation and urban decay until someone decides to pay people to rebuild.

Which brings us to taxes. Your taxes don't go to other people. Taxes are merely a way to force money circulation through the macro-economic formulas of the Fed and the Reserve banks. What do you think the deductions represent? They represent legitimate expenses that help keep everything moving, your positive economic impact on the world around you. Whether or not that's true or real isn't the issue, it's the assumption behind the system. At the heart of it all, we are individual people trying to navigate through the blanket generalizations of local, state, and federal government because most people aren't willing or prepared to live every moment as a complete surprise the way i do (totally true, by the way).

The Fed's job is to try to keep things functioning. Interest rates are only 1 little tool, and can't solve every problem. Sometimes you have to buy $1,000 toilet seats to get money flowing where you think it should go. If you think Congress is messing with the money supply at a dangerous level, then you have to realize that private citizens aren't actually spending enough to keep the whole thing running smoothly without their intervention. If it were functioning properly, Congress wouldn't have anything to congregate about. Markets crash all the time, and big companies crash big. Little companies don't cause as much damage, so big companies get bailed out, little companies don't. Fair or nice doesn't factor into our system because every part of it is based on a mathematical guesstimate. Investors are literally thinking up new ways to trade money back and forth, just to see how it turns out. A whole bunch of people seem to think that's a more productive use of money than using it to buy and sell tangible commodities. I don't need this 3 million right now, let's see if i can turn it into 4 million with some creative accounting. Oops! Guess we'll need to adjust this variable over here and try again. Sell that land, those buildings, and layoff 900 workers to get us back in the black.

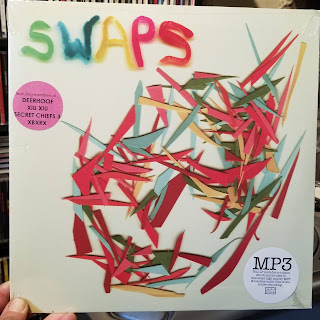

This is all getting a bit dry and abstract, let's play a record. I doubt it will be relevant, but i've got a whole new stack of weird stuff. A 10"? Didn't realize when i bought that. This whole batch of records is sub $20 stuff from Barnes & Noble, by the way. That means these bands didn't really make any money from them. Swaps? Whaddya know, it is relevant.

Interest rate swaps are just that. The most common is fixed for floating, meaning one guys sends money to another at an agreed fixed rate, but receives return payments according to a floating (variable) rate schedule in the future. Heads up guys, next year you gotta have 20% growth or go bankrupt. It's one of the many instruments hedge funds use to speculate with their hoardings. What you need to know is that behind the scenes, people are playing around with lending money back and forth just to see if their mathematical models are accurate.

The album Swaps is two 11+ minute tracks of glorious cacophony. If i really did own a record store, this would be in the Delightful Gibberish section. It's experimental noise music, like your children might play if you hand them 27 different instruments and a hammer. Actually it's the perfect soundtrack to my nonsensical ramblings about the economy. Go torture your brain a little with Pair Bonds and Aether Defects by Swaps. I have hand numbered copy 117/483, in case you wanted to know.

Comments

Post a Comment